Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

The TCDRS office will be closed on Thursday, April 17 at 2 p.m. and Friday, April 18 in observance of Good Friday.

Making Administration Easy

All you need to know about enrolling employees, reporting and submitting payroll, correcting errors, and more.

Enrolling employees

Easy Online Enrollment

Enroll your employees online to start them on their journey toward a more confident retirement. We’ll send each new member welcome information, including an explanation of how their benefit works along with an invitation to register online and explore our Members Section.

Employee Participation

All of your employees must be enrolled in TCDRS — only temporary employees may be excluded.

Learn MoreNo Probationary Periods

If you have a waiting period for health benefits, you must still deduct retirement deposits starting with the employee’s first paycheck.

Special Categories

There are several special membership categories that might impact an employee’s enrollment in TCDRS.

Learn MoreDetermining Compensation

An Easy Calculation

You calculate an employee’s retirement account deposit based on their gross monthly pay, before federal income taxes and other deductions. Do not deduct an employee’s voluntary pay reductions to 457, 401(k) or other deferred compensation plans from his or her gross monthly salary before determining compensation for TCDRS.

This amount should include:

- Wages

- Sick pay

- Vacation pay

- Travel allowance*

- Car allowance*

- Uniform allowance*

- Value of non-monetary compensation (such as housing)

- Retroactive pay based on an adjustment or judgment

- Annual or periodic salary supplement from federal, state or local sources (such as state supplement to county judges)

- Any additional taxable income

*Only include these allowances as part of an employee’s compensation if the allowance amount is included as income on the employee's W-2.

An employee’s compensation should not include:

- Worker’s compensation payment

- Damages awarded along with retroactive pay

Calculating the Deposit

To calculate each employee’s TCDRS deposit: Multiply the employee’s compensation by your organization’s employee deposit rate. You can find your employee deposit rate in your Plan Information located in the Employer Portal.

IRS Limits on Employee Deposits

Because TCDRS is a qualified defined benefit plan, the IRS places a limit on the amount of compensation you use to calculate an employee's deposit. The limit for 2025 is $350,000. This limit may change every year and only affects highly compensated employees.

Calculation Example

Monthly compensation = $1,750

Deposit rate = 7% (0.07)

$1,750 x .07 = $122.50

Combine all the deposits from your payroll from the month and report that total to TCDRS.

Additional Reporting Help

Employer Rate Calculation

Your system may use individual salaries to automatically calculate the employer matching and Group Term Life contribution rates. However, if you need to calculate your employer contribution rate manually, you can use the formulas to the left.

To Calculate Employer Matching:

Employee Deposit ÷ Employee Deposit Rate

x Employer Contribution Rate

To Calculate Group Term

Life Premiums:

Employee Deposit ÷ Employee Deposit Rate

x Group Term Life Contribution Rate

Submitting Payment

There are three different ways to submit your payments to TCDRS:

ACH Credit

- Allows you to initiate a payment to TCDRS from your bank account through the ACH network.

- Does not always transfer funds to TCDRS on the same day. If you choose this payment method, please keep your payment due date in mind when scheduling your payment.

- In addition to payroll reporting payments, you can use ACH credit for one-time payments, such as lump-sum contributions.

Wire Transfer

- You can use a wire transfer to move funds directly between banks on the same day. You initiate the transfer.

- Before choosing this method, please discuss the process with your bank representative, so you understand wire transfer deadlines and associated fees.

- In addition to payroll reporting payments, you can use wire transfer for one-time payments, such as lump-sum contributions.

ACH Debit

- ACH debit allows TCDRS to transfer money from your county or district bank account to our bank account.

- We never withdraw money from your account before the report due date for the month.

- To sign up for ACH debit, please contact your Employer Services Representative.

Late Penalties and Extensions

By law we are allowed to charge employers $500 plus interest past-due reports and amounts.

Interest is charged at an annual rate of 12 %, calculated daily from the original due date until TCDRS receives the reports and the funds.

We understand that sometimes circumstances beyond your control may cause a delay in your reporting and payment. To ask for an extension, you can upload this request from the Employer Portal or fax it to complete the Request for Filing Extension (TCDRS-94). It must arrive in our offices by the regular due date. You can upload this request from the Employer Portal or fax it to TCDRS at (512) 328-8887, Attention: Employer Plan Management.

Payroll Reporting

Checking All the Boxes

Payroll reporting is one of the most important duties you perform as a TCDRS plan administrator, so we’ve made the process easy and available online.

Step 1

Sign into the Employer Portal

Upload your files and have instant access to contribution rates, plan information and more.

Step 2

Send Us Your Payroll Data and Payment

You can securely transmit your payroll data file as a text file (.txt) through this website.

Step 3

Payment is Due the 15th of the Following Month

We are legally required to charge late penalties and interest for payments received after the deadline.

Correcting Errors

Staying on Track

An uncorrected reporting error could cost your organization additional money. For example:

- If you overstate or understate an enrolled employee’s deposits

- If an employee was not enrolled in TCDRS, but should have been

To correct an error, an adjustment to your prior payroll report must be submitted to TCDRS online through the Employer Portal.

Employment Changes

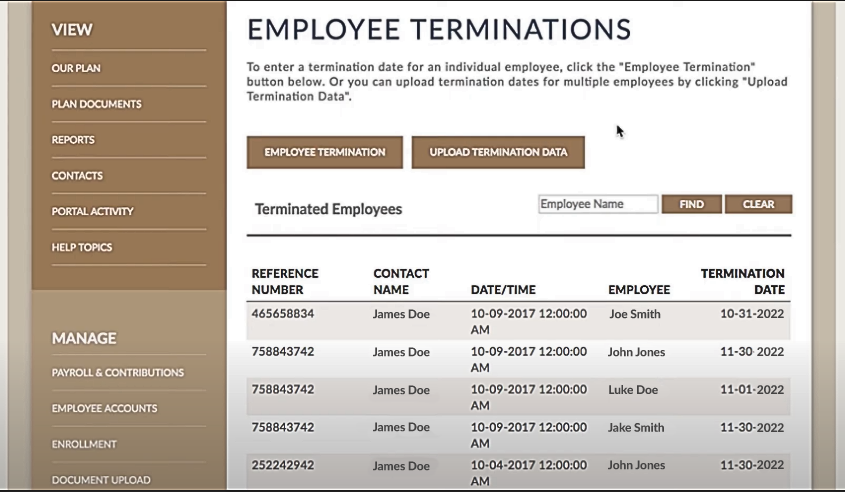

An Employee’s

Last Day

Letting us know an employee’s last day of employment saves you time, reduces paperwork and will help ensure that there are no delays when a former employee requests a withdrawal or wants to retire.

- You can enter an exit date for your employees as soon as you get notice that they are leaving or retiring.

- You can enter exit dates for employees individually or you can upload a file in the Employer Portal that contains exit dates for many employees. See a sample.

- Uploaded files must be in a CSV format. Get Instructions.

Review reports for your employer, including last day of employment, pending retirement and withdrawal reports, on the Employer Portal.

If you have any questions about how to enter exit dates, please call TCDRS Employer Services at 800-651-3848

Rehiring Employees & Retirees

In order to avoid jeopardizing your plan’s qualified, tax-deferred status, we strongly encourage you to carefully evaluate your human resource policies concerning rehiring retirees and former employees.

Employer Handbook

Take a deep dive into TCDRS plan administration by downloading our Employer Handbook. Free printed copies are also available by contacting your Employer Services Representative.

How to Fill Out

IRS W-2s

Do not include the required employee contribution in wages subject to federal income tax. Include the required TCDRS employee contribution when reporting Social Security and Medicare wages. If your employer participates in our Group Term Life program, that could also affect how you fill out W-2s.