Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Coming Soon for Retirees: 1099-Rs, Benefit Statements and Direct Deposit Magnets

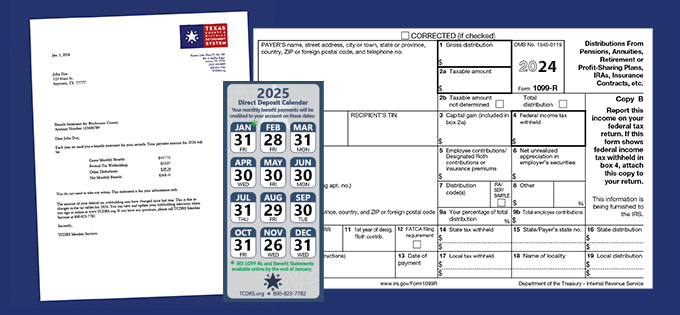

Winter is coming... and so are your IRS 1099-R, TCDRS Benefit Statement and 2025 Direct Deposit Calendar Magnets!

Attention, TCDRS retirees! As 2024 draws to a close, we are preparing your account documents, including your IRS 1099-R, TCDRS Benefit Statement and, of course, your 2025 direct deposit magnets.

Your 1099-R shows how much money TCDRS sent you the previous year and how much was withheld for taxes. You will need this document for tax filing.

Your TCDRS Benefit Statement shows what your benefit payment will be for the upcoming year. Your payment amount may change from year to year due to tax table changes or if your employer passes a cost-of-living adjustment.

Here’s what you need to do and know:

Let Us Know If You’ve Moved

If you moved recently, please sign into your TCDRS.org account or call TCDRS Member Services at 800-823-7782 at your earliest convenience to ensure your physical mailing address is updated in your account.

Watch your Mailbox For Your Magnet

We will mail your direct deposit calendar magnet out in December.

Register Online to Access Your Documents in January

If you have registered online at TCDRS.org, you will be able to access your 1099-R and Benefit Statement in your online account by January 23. We will send you an email when your documents are available.

We will mail your 1099-R by January 31. Please allow 15 days for arrival.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Online Counseling for TCDRS Members

Online counseling is having a face-to-face counseling session with a TCDRS representative from the privacy of your home or office. A...

Read more

08.09.2021

TCDRS.org — Your Retirement Compass

The secret to enjoying a smooth retirement adventure.

Read more

07.15.2022

Market Volatility and Your TCDRS Account

Your TCDRS account is designed for stability. It will continue to grow regardless of the ups-and-downs of the market.

Read more