Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

3 Ways to Grow Your Retirement Savings

Midway through your career, you’ve probably started saving for retirement. But do you know the best ways to help your money grow?

By Rebecca L. Bennett

Planning for retirement is not unlike tending a garden. It requires careful attention, strategic planning and consistent effort to ensure a bountiful harvest someday. Midway through your career, you may have already started growing your retirement savings — now it’s time to take steps to help them thrive.

Get Vested in TCDRS

Since your TCDRS account automatically grows with every paycheck and earns 7% annual compound interest every year, your first goal should be to become vested. With TCDRS, being vested means you have enough service time to receive a lifetime monthly benefit when you become eligible and choose to retire. This could be 5, 8 or 10 years, depending on your employer’s vesting requirements.

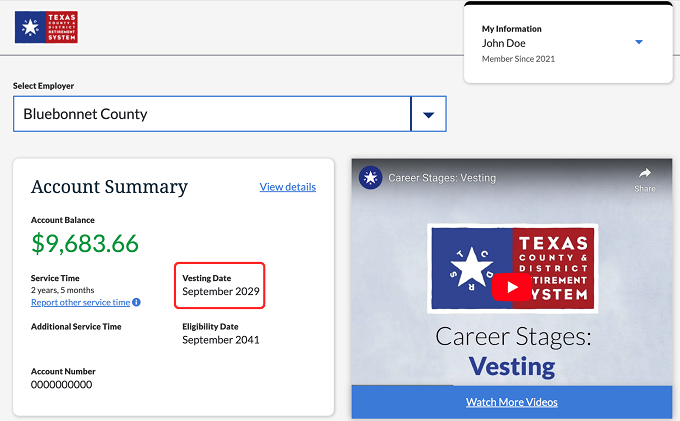

The fastest way to determine if you’re vested is by signing into your TCDRS.org account. In the “Account Summary” box on your dashboard, you will see the month you will officially become vested under “Vesting Date”.

We recommend signing into your TCDRS.org account regularly to watch your money grow and run benefit estimates.

Save More for Your Future

Your TCDRS benefit should be an important part of your plan for retirement — but it shouldn’t be your only plan. Experts recommend having multiple streams of income in retirement through a combination of Social Security benefits and additional retirement accounts, such as 457s and IRAs.

Check out these articles for more information opening additional accounts:

Make Investing a Habit

The other important thing to remember is that just like a garden needs steady nourishment to thrive, it’s important to consistently water your investments. Once you’ve started growing your savings in additional retirement accounts, contribute to them routinely to benefit from dollar-cost averaging.

Experts recommend setting up automatic transfers straight from your paychecks into your accounts so you aren’t tempted to siphon from your retirement deposits — and increasing your contributions when you receive windfalls and raises.

Building a health emergency fund and rainy day fund can also help you avoid needing to pause your retirement contributions by easing the financial blow when life happens.

For additional resources on growing your retirement savings and determining when to start the harvest, visit TCDRS.org, attend one of our free financial webinars or schedule a free online counseling session with one of our friendly representatives to go over your account.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

Put Your Wishes in Writing

Many people think of terms like “power of attorney” and “estate planning” only when they near the end of their working life. But ther...

Read more

09.09.2024

The Ultimate Quest: Leveling Up Your Finances for Retirement Victory

It’s time to gear up and get ready for retirement! Whether you’re just starting your journey or preparing for the final level, here a...

Read more

09.23.2024

What’s Your Retirement Money Management Style?

In retirement, are you more of a saver or a spender? Has living on a fixed income felt pretty comfortable, or are you feeling the pin...

Read more