Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Member Annual Statements are now available online. Sign into your account and go to the Documents card on your dashboard to view.

Have Questions? Read our Annual Statement FAQs

A Diversified Portfolio

How do you achieve your investment goals in volatile markets? Diversify. Our broadly diversified portfolio is designed to achieve our long-term return goals with an acceptable level of risk.

Having many types of investments not only reduces our exposure to risk, but also allows us to take advantage of opportunities across a variety of asset classes and even within the classes themselves.

Our Planning Cycle

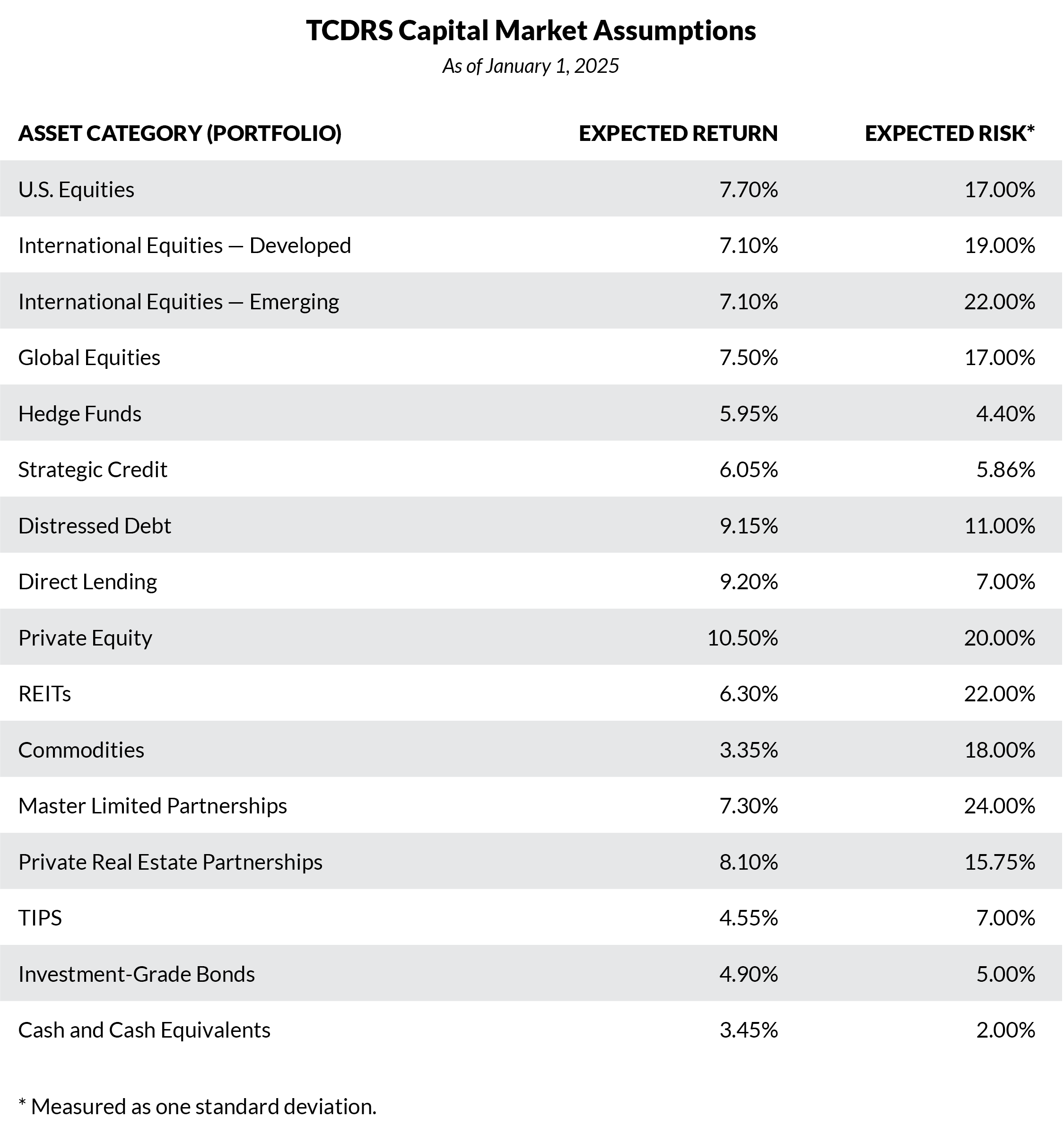

It’s great that we’ve met our investment goal in the past, but we spend most of our time thinking about the future. Every year, our board of trustees reviews and updates our capital market assumptions. Those assumptions, which are created with guidance from outside investment advisors, are forward-looking expectations of the return, risk and correlation of each of our asset classes. We then model thousands of potential asset class combinations to help our trustees and investment staff create a portfolio that will ultimately meet our long-term expected return goal with an acceptable level of risk.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

How TCDRS Reports Performance

At TCDRS, we’re constantly monitoring our investments. All of our investment performance is reported net of all investment fees.

Read more

Managing Investment Risk

Risk is a factor in any investment, and we manage risk very closely. Fortunately, we have a great track record of meeting our perform...

Read more

04.02.2024

2024 TCDRS State of the System

Get an inside look at TCDRS' 2023 investment return and how it may impact your rate and annual plan decisions.

Read more