Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Going Where Your Career Takes You

Find out how your TCDRS account travels with you through the various stages of your career and how it can help with your retirement planning.

Retirement planning is a life-long process, no matter where your career takes you. There are many decisions you’ll need to make along the way to ensure a comfortable retirement and strengthen your family’s financial security.

Sounds like a lot of work, right? It can be, but the good news is you don’t have to be a financial expert.

In this article, we show you how your TCDRS account travels with you through the various stages of your career and how it can help with your retirement planning.

If you need more specific guidance, we recommend you consult a financial planner.

Starting Your Career

Since you’re in the early stages of your career, it’s important you see how TCDRS factors into your overall retirement planning.

How TCDRS Works

-

A percentage of your paycheck is deposited into your TCDRS account. That percentage (from 4% to 7%) is set by your employer.

-

Your savings grow at an annual, compounded rate of 7% interest.

-

Once you retire, you receive a benefit payment for life that is based on your final account balance and employer matching.

How Your Money Grows

Your account earns 7% interest compounded annually. TCDRS credits this interest to your account each Dec. 31, based on your account balance as of the previous Jan. 1. Over time, the value of your account can increase a great deal because of compounding — that is, earning interest on interest. For example:

At 7%, your money would double about every 11 years.

To view your account details, simply sign in or register for online account access.

A Few Important Notes

-

Your employer decides how much will be withheld from your paycheck and deposited into your TCDRS account. Beyond that, you may not make additional deposits into your TCDRS account.

-

You cannot withdraw money from your TCDRS account while you are still working for your current employer.

-

You may not borrow money or get loans from your TCDRS account.

More Ways to Save for Retirement

Your TCDRS account is only one part of your retirement savings. Personal savings, IRAs and reducing your debt are just a few ways you can strengthen your retirement plan. Saving early, even a little, can enhance your retirement.

Leaving Your Job

You don’t have to withdraw your TCDRS account just because you’re leaving your job. In fact, there are a lot of good reasons to leave your money in TCDRS:

-

Your account continues to grow at 7% compound interest.

-

When you become eligible and choose to retire, you will receive a lifetime monthly benefit.

-

If you’ve completed four years of service, you are eligible for a Survivor Benefit.

You have three options when leaving your TCDRS employer.

Option 1: Keep Your Money in TCDRS

To keep your money in your TCDRS account, all you have to do is keep your account information up-to-date with us. We need your current address and your current beneficiary information.

Your money will earn interest for as long as you keep it in TCDRS.

However, there is a limit to how long you can keep your money in your TCDRS account. The IRS requires you to start taking money out of your retirement account when you reach age 72. If you’re vested by that time, you can choose to get a monthly benefit, which will include employer matching. If you’re not vested, you can withdraw your money.

Option 2: Roll Over Your Account

You can avoid paying taxes or penalties by rolling your money over into another tax-deferred retirement account. These accounts include traditional IRAs or your new employer’s retirement plan (if it allows rollovers). However, you lose employer matching with any rollover and you forfeit your lifetime benefit.

You can apply for withdrawal by signing into your online account. When you complete the application, choose the direct rollover option and provide the name of the plan or account into which you’re rolling your money.

We will send you a check made out to the financial institution you designate two to four weeks after we receive your application.

The following January, we will send you an IRS Form 1099-R detailing how much money you rolled over. You’ll need to file your 1099-R with your income tax return.

Option 3: Withdraw Your Account

If you choose to withdraw your money from TCDRS, you may want to check with a tax professional or the IRS first. Your withdrawal will be subject to a minimum 20% withholding for taxes, you may face a 10% withdrawal penalty at tax time and your withdrawal could significantly affect your income taxes.

In addition, withdrawing your TCDRS account means you lose employer matching and forfeit your lifetime benefit from that account.

Before you withdraw your money, it’s a good idea to talk to a financial professional about how a withdrawal will affect your personal tax situation.

To withdraw your money, sign into your TCDRS account online and complete our online withdrawal process.

We will send you a direct deposit for the total amount of your account balance, minus the tax withholding, two to four weeks after we receive your application.

The following January, we will send you an IRS Form 1099-R detailing how much money you withdrew and any taxes you withheld. You’ll need to file your 1099-R with your income tax return.

Changing Your Mind

Once your payment has been deposited into your bank account, your withdrawal is final. You cannot take back your decision.

For rollover checks, you have 60 days from the date on the check to return. To cancel, send the check back to TCDRS and ask us to void the check.

Once we have received or voided your check, we can restore your TCDRS account.

Returning to Work

If you withdrew or rolled over your TCDRS account and later return to work with your former employer, there are certain requirements you must meet in order to keep the money you withdrew.

-

You cannot have a prior agreement or understanding with your former employer that you will be rehired.

-

You must have a break in service of one full calendar month. For example, if your employment terminated on April 15, you can’t go back to work for that same employer before June 1. The entire calendar month of May must pass before you can be rehired.

If you don’t have a full calendar month break in service with your former employer, or if you had an agreement to be rehired, then you must return the money you withdrew from your TCDRS account. That includes money you rolled over into another qualified retirement account, such as a traditional IRA.

If you have concerns about returning to work for your former employer, please talk to that employer’s human resources department.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

3-Minute Retirement Checkup

It starts with a visit to our benefit payment estimator.

Read more

08.03.2021

How to Select Your Beneficiary Online

The easiest way to select, review and update your TCDRS beneficiary (or beneficiaries) is through your online account at TCDRS.org. ...

Read more

04.18.2022

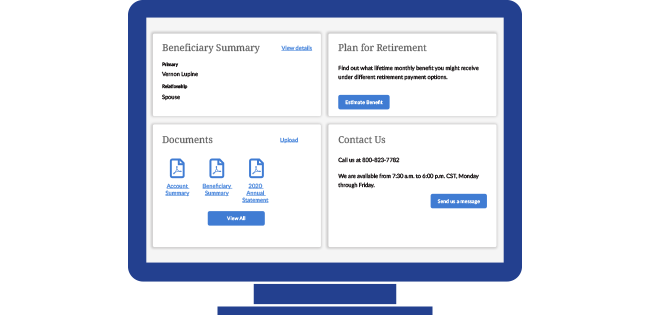

What Members Can Do Online

There are more reasons than ever to register online at TCDRS.org.

Read more