Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Controlling Plan Costs

No one knows for sure how much your retirement benefits will actually cost until all benefits are paid. But with TCDRS, you have the flexibility and local control to help you manage your plan costs.

Why do rates change?

There are many reasons your required rate can change. Three major ones are plan changes, actuarial gains and losses, and paying more than required.

-

Plan changes: When you adopt a plan change, your required rate can change. Benefit increases, including retiree cost-of-living adjustments, cause your rate to go up, while benefit decreases cause your rate to go down. Please note that benefit decreases can only be applied to future employment, not to the benefits your employees have already earned.

-

Actuarial gains and losses: Since we don’t know exactly what the future holds, we use demographic and economic actuarial assumptions to estimate what will happen to your plan. As actual experience varies from the estimated, actuarial gains and losses are created. For example, an actuarial assumption is that a certain mid-career employee will get a 3.5% salary increase the next year. Instead the employee gets a promotion and a 10% salary increase. Because of the larger-than-expected salary increase, the individual now has a larger estimated projected benefit than he or she did the previous year. This creates an actuarial loss and could cause your required rate to go up.

-

Paying more than required: Choosing to contribute to your plan at a higher elected rate or making an additional contribution can cause your required rate to decrease.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

GASB 68 and Your Financial Reporting

Your GASB 68 Report provides you with the information you need to complete your audited financial statement. This report is available...

Read more

TCDRS at Other Conferences

TCDRS Employer and Member Services Representatives are available as presenters and exhibitors at other conferences across Texas. Cont...

Read more

07.29.2025

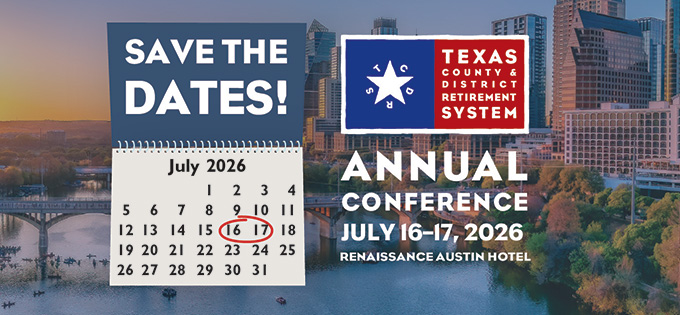

TCDRS Annual Conference

Save the dates for the 2026 TCDRS Annual Conference! Join us at the Renaissance Austin Hotel on July 16-17, 2026.

Read more