Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

The TCDRS office will be closed on Wed., Dec. 31 at 2 p.m. and Thurs., Jan. 1, in observance of New Year's Day.

Evaluating Your Plan Benefits

As an employer, you decide the level of your benefits based on your employees’ needs and your local budget. You can also choose to contribute more than your required rate to your plan.

How to evaluate your benefits

We encourage you to review your plan each year to make sure your benefits are adequate and affordable to fund. When you are reviewing your benefits, you may want to consider:

-

How much of your employees’ pre-retirement income would you like to replace when they retire? Your plan assessment will show you what replacement income you are currently providing. To view your plan assessment, sign into your employer account.

-

How much should employees contribute toward their retirement?

-

When should your employees be able to retire?

-

What can you do to help your retirees cope with inflation?

-

What other benefits (such as retiree healthcare) do you provide your employees?

-

Can you afford these benefits?

The Plan Customizer, our online plan modeling tool, can help you see how different combinations of benefits will affect your plan costs and what your employees receive when they retire. To access the Plan Customizer, sign in as an employer on this website.

If you need help defining the best program for your workforce, contact your Employer Services Representative at 800-651-3848.

Making additional contributions

Contributing more than your required rate creates a buffer against future adverse experience (such as investments not performing as expected or your payroll not growing as expected). You may also make additional contributions to prefund a future benefit increase or pay down your liabilities faster than required.

There are two approaches:

-

Paying an elected contribution rate: Paying a higher rate than your required contribution rate. This also increases the likelihood that your required rate will stay the same from year-to-year, which can make budgeting easier.

-

Making an additional contribution directly to your employer account.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

GASB 68 and Your Financial Reporting

Your GASB 68 Report provides you with the information you need to complete your audited financial statement. This report is available...

Read more

TCDRS at Other Conferences

TCDRS Employer and Member Services Representatives are available as presenters and exhibitors at other conferences across Texas. Cont...

Read more

07.29.2025

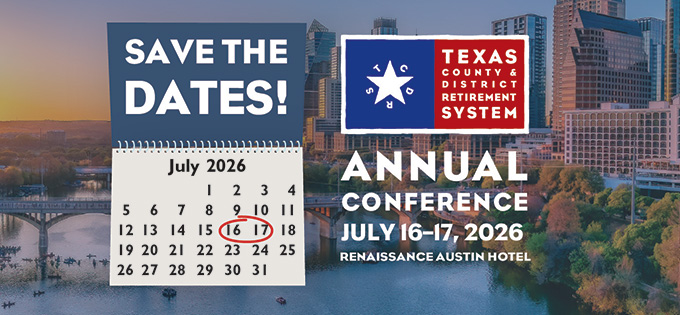

TCDRS Annual Conference

Save the dates for the 2026 TCDRS Annual Conference! Join us at the Renaissance Austin Hotel on July 16-17, 2026.

Read more