Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

GASB 68 and Your Financial Reporting

Your GASB 68 Report provides you with the information you need to complete your audited financial statement. This report is available each May when you sign into your employer account on this website.

What you will need

Your GASB 68 Report provides you with the information you need to complete your audited financial statement. This report is available each May when you sign into your employer account on this website.

You can also refer to our GASB 68 Playbook for help with applying your GASB 68 Report to your financials.

If you have multiple financial statements, you may want to allocate your net pension liability, pension expense and deferred inflows/outflows to subsets of your organization, such as different funds, divisions or departments for reporting purposes. If you need to do this, please contact your Employer Services Representative at 800-651-3848.

If you were not participating in TCDRS as of Dec. 31 of last year, you will only need to show a limited amount of plan information on your financials. TCDRS will provide you with the plan description you’ll need for your note disclosures. In addition, you’ll need to account for contributions made after the measurement date (Dec. 31) but before the end of your fiscal year as a deferred outflow of resources. These contributions include employer contributions, but not member deposits or Group Term Life premiums. Please contact your Employer Services Representative and they can help you determine this amount.

Definitions

Total Pension Liabilities: The portion of the actuarial present value of projected benefit payments that is attributable to past periods of employee service.

Fiduciary Net Position: These are resources accumulated (plan assets) and held in trust to pay for the benefits represented by the total pension liability.

Net Pension Liability: The difference between the value of total pension liabilities and fiduciary net position.

Deferred Inflows/Outflows: Deferred inflows/outflows refer to items that are not yet recognized in the net pension liability. Three types of items are covered in this category:

- Difference between projected and actual investment results

- Actuarial gains and losses

- Employer contributions made after the measurement date (Dec. 31) through your fiscal year end

Pension Expense: In the past, your pension expense was based on your employer contributions. Because of the separation between your plan funding and accounting, that’s no longer the case. For your accounting, pension expense is the change in net pension liability from year to year, adjusted for the change in deferred inflows/outflows.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

TCDRS at Other Conferences

TCDRS Employer and Member Services Representatives are available as presenters and exhibitors at other conferences across Texas. Cont...

Read more

03.10.2021

Adjusting the Investment Return Assumption

The TCDRS Board of Trustees adjusted the long-term investment return assumption to synchronize with long-term return expectations.

Read more

07.29.2025

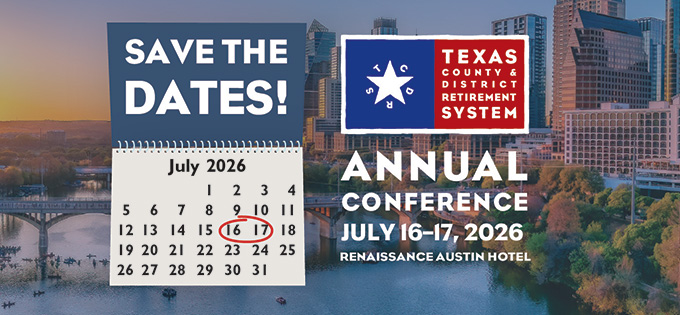

TCDRS Annual Conference

Save the dates for the 2026 TCDRS Annual Conference! Join us at the Renaissance Austin Hotel on July 16-17, 2026.

Read more