Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Due to planned road closures for the Trail of Lights event, the TCDRS building will close at 4:30 p.m. daily from Wed., Dec.10 through Tues., Dec. 23.

Service hours remain unchanged, and Member Services can still be reached after the building has been closed.

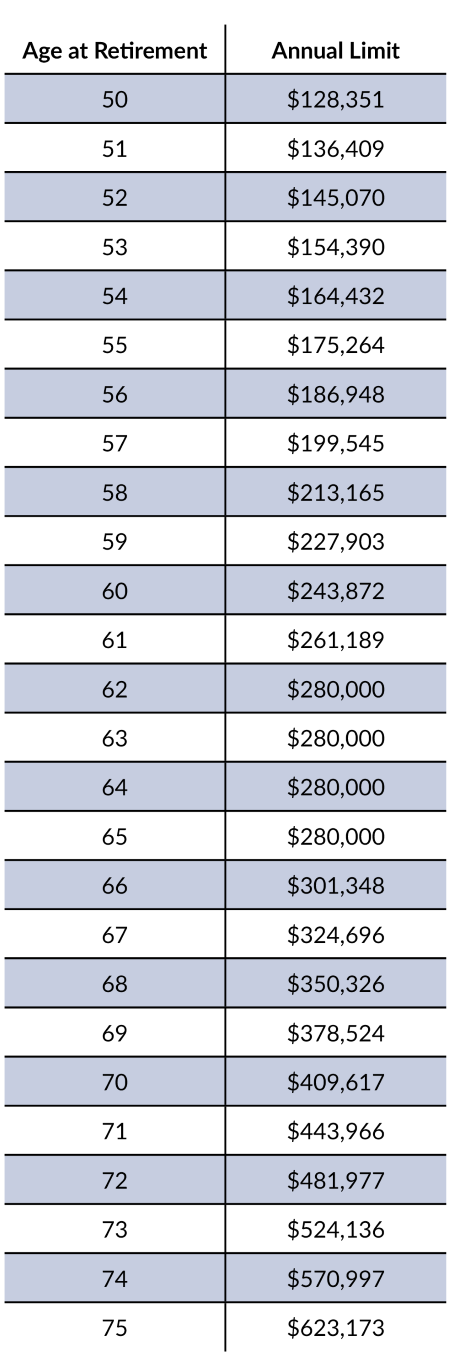

IRS Benefit Payment Limits 415(b)

Under IRS rules, there’s a limit on the annual benefit payments a retiree can receive from TCDRS. This limit depends on the retiree’s age at retirement and adjusts yearly based on inflation (using the Consumer Price Index). The chart below shows the current 415(b) limits. Other factors, like the payment option chosen or the retiree’s relationship with their beneficiary, can also affect these limits.

When the Limit Applies

This limit generally affects only long-serving, highly paid employees. If any of your employees are expected to receive benefits exceeding the allowable amount, TCDRS will pause payments once the annual limit is reached. Payments will resume the following year unless your organization has adopted a Qualified Benefit Replacement Arrangement (QBRA).

Qualified Benefit Replacement Arrangement (QBRA)

A QBRA ensures that retirees, who are subject to 415(b) limits, receive their full annual benefit without increasing your organization’s cash outflow.

How QBRA Works:

-

TCDRS pays the retiree until they reach the annual 415 limit.

-

After that, your organization pays the retiree directly for the rest of the year.

-

You can reduce your monthly employer contributions by the amount you pay the retiree, so your overall cash flow remains unchanged.

-

TCDRS will notify you of any payments you need to make and the corresponding reduction in contributions.

-

You will need to withhold taxes from benefit payments and provide certain tax information for QBRA payments. TCDRS will help guide you through this.

Adopting a QBRA is optional, and you can opt out annually if you choose.

If you would like to set up a QBRA, please contact your TCDRS Employer Services Representative at 800-651-3848.

Annual Review and Notification

Each year, TCDRS checks if any of your employees might be affected by the 415(b) limits when they retire. If anyone is impacted, we’ll inform you and discuss adopting a QBRA to ensure they receive their full benefits.

Taxes and Reporting

QBRA payments are treated as wages, requiring federal income tax withholding and reporting on a Form W-2. This reporting is mandatory.

While there’s no official guidance on FICA withholding, employers can reasonably take the position that QBRA payments are not subject to FICA, either because FICA was already paid, or the original wages were exempt. Please consult your tax counsel for advice.

Example

A retiree is due to receive $240,000 from TCDRS in a year ($20,000 per month). If their 415(b) limit is $200,000 for the year, TCDRS will make payments for the first 10 months. For the remaining two months, your organization pays the $20,000 monthly benefit, and you reduce your employer contributions by that amount.

The following year, the retiree’s limit adjusts for inflation, and TCDRS payments resume until the new limit is reached.

415(b) Benefit Limits for 2025

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

TCDRS at Other Conferences

TCDRS Employer and Member Services Representatives are available as presenters and exhibitors at other conferences across Texas. Cont...

Read more

03.10.2021

Adjusting the Investment Return Assumption

The TCDRS Board of Trustees adjusted the long-term investment return assumption to synchronize with long-term return expectations.

Read more

07.29.2025

TCDRS Annual Conference

Save the dates for the 2026 TCDRS Annual Conference! Join us at the Renaissance Austin Hotel on July 16-17, 2026.

Read more