Updating your browser will give you an optimal website experience. Learn more about our supported browsers.

Keeping your rates stable

The only way to reduce the overall cost of your plan is to lower benefits. However, there are strategies that can help keep your rate more stable from year to year.

Rate stabilization strategies

You can create a buffer against adverse plan experience (such as a down investment year or payroll that doesn’t grow as expected) by contributing at an elected rate that is higher than your required contribution rate.

More than 35% of TCDRS employers choose to pay an elected rate to help build reserves and make their budgeting more predictable.

If your required employer contribution rate is decreasing in 2021, you may choose to keep paying the 2020 amount as an elected rate to boost your reserves. If you would like assistance determining an elected rate that has a higher chance of remaining stable from year-to-year, reach out to your TCDRS Employer Services Representative.

Another option is making an additional, one-time contribution to your plan. Employers sometimes use this strategy to prefund a future benefit increase or pay down liabilities faster than required.

When you make plan decisions for 2021, keep in mind that the impact of the pandemic and any potential investment losses will affect your rates in 2022 and beyond. Benefit increases such as cost-of-living adjustments (COLAs) and matching increases can stack on investment losses.

Looking ahead

TCDRS is built to weather storms. We have made it through the Tech Bubble bursting, the Great Recession and other market cycles. We have a long-term investment horizon and utilize system-wide reserves and smoothing to help keep your rates stable.

We empower you with the tools needed to keep your plan affordable. Our plan design gives you flexibility and local control over your financial commitments while providing stable benefits.

If you have any questions about strategies you can use to help stabilize your rates, please call your TCDRS Employer Services Representative at 800-651-3848.

Related Content

Get more information on why TCDRS is a model plan when it comes to retirement.

TCDRS at Other Conferences

TCDRS Employer and Member Services Representatives are available as presenters and exhibitors at other conferences across Texas. Cont...

Read more

GASB 68 and Your Financial Reporting

Your GASB 68 Report provides you with the information you need to complete your audited financial statement. This report is available...

Read more

07.29.2025

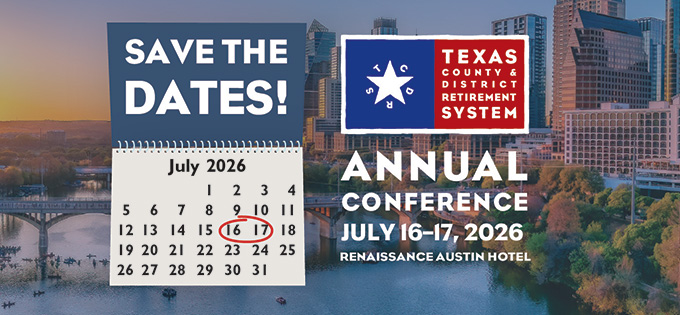

TCDRS Annual Conference

Save the dates for the 2026 TCDRS Annual Conference! Join us at the Renaissance Austin Hotel on July 16-17, 2026.

Read more